consultingtrading.site Overview

Overview

Pre Qualified For Student Loan Forgiveness

Only Federal Direct Loans are eligible for PSLF. You will need to consolidate before June 30, , to take advantage of the Department of Education's one. Loans must be Federal guaranteed loans (i.e., Stafford, Ford, or Perkins loan ONLY). Federally recognized loans made must be insured or guaranteed through a. If you have loans that have been in repayment for more than 20 or 25 years, those loans may immediately qualify for forgiveness. Borrowers who have reached Nursing school faculty from disadvantaged backgrounds who have at least a two-year contract to teach nursing at a public or nonprofit school are eligible for up. Public Service Loan Forgiveness (PSLF) is a federal program that forgives the remaining balance on your Direct Loans after you have made qualifying monthly. Lifetime Learning Credit: You may be eligible for a lifetime learning credit of up to $2, per eligible student for qualified education expenses. Student Loan. Direct Loans are the only types of loans that qualify for PSLF. If you have federal student loans that are not Direct Loans, you may be able to consolidate. “Act immediately to qualify for student loan forgiveness before the program is discontinued.” “Your student loans may qualify for complete discharge. 31, , you can get credit for any months spent in repayment on these federal student loans: Federal Family Education Loan (FFEL) Program loans, including. Only Federal Direct Loans are eligible for PSLF. You will need to consolidate before June 30, , to take advantage of the Department of Education's one. Loans must be Federal guaranteed loans (i.e., Stafford, Ford, or Perkins loan ONLY). Federally recognized loans made must be insured or guaranteed through a. If you have loans that have been in repayment for more than 20 or 25 years, those loans may immediately qualify for forgiveness. Borrowers who have reached Nursing school faculty from disadvantaged backgrounds who have at least a two-year contract to teach nursing at a public or nonprofit school are eligible for up. Public Service Loan Forgiveness (PSLF) is a federal program that forgives the remaining balance on your Direct Loans after you have made qualifying monthly. Lifetime Learning Credit: You may be eligible for a lifetime learning credit of up to $2, per eligible student for qualified education expenses. Student Loan. Direct Loans are the only types of loans that qualify for PSLF. If you have federal student loans that are not Direct Loans, you may be able to consolidate. “Act immediately to qualify for student loan forgiveness before the program is discontinued.” “Your student loans may qualify for complete discharge. 31, , you can get credit for any months spent in repayment on these federal student loans: Federal Family Education Loan (FFEL) Program loans, including.

There are currently several ways to attain student loan forgiveness for federal student loans. more. Related Articles. How do I register my Master Student Financial Assistance Agreement (MSFAA)?. Repayment. Am I required to make payments on my student loan if I return to school? Pre-approved Credit Card. Select from the following5. Scotiabank Gold American loan and follow a monthly repayment schedule. What are the interest. To get federal student loans, fill out the Free Application for Federal Student Aid (FAFSA) each year before the deadline. You'll get a call from someone claiming to be affiliated with the government or your loan provider promising to reduce or eliminate student loan debt. Lifetime Learning Credit: You may be eligible for a lifetime learning credit of up to $2, per eligible student for qualified education expenses. Student Loan. The Public Service Loan Forgiveness (PSLF) Program forgives the remaining debt on eligible loans for borrowers who have worked at least 10 years in public. The program enables employees to reduce student loan debt incurred to support courses of study already completed by the employee or completed by the child of. Internships can earn $2, in student loan forgiveness. Nurses can Get Pre-Qualified. Getting your rate is quick and easy without impacting your. Submit one form for pre-qualification and compare real rates from 17+ private student lenders. It takes three minutes. Find my rate. 31, , you can get credit for any months spent in repayment on these federal student loans: Federal Family Education Loan (FFEL) Program loans, including. If you work for a qualified employer—including many Head Start, preschool and child care programs—you may now be eligible for federal student loan forgiveness. Practitioners who work part time may receive up to 50% in loan repayment on qualifying educational debt, up to a maximum of $17, per obligation year, for an. You may qualify for an enhanced Repayment Assistance Plan (for Alberta loans only). In extreme circumstances, a borrower with a disability may be eligible for. Nova Scotia Loans begin to accumulate interest six months after you leave school, unless you apply for and qualify for 0% interest. Canada Student Loans are. The Public Service Loan Forgiveness (PSLF) Program forgives the remaining balance on your Direct Loans after you have made (10 years) qualifying monthly. Refinance Loan. A loan designed specifically for borrowers in repayment to manage their student debt. Application Process Made Easy. 1. Check your eligibility. How to Get Student Loan Forgiveness. If you have federal student loan debt, here are some steps you can take to evaluate your eligibility for June FinWise Bank to offer income-based repayment loans to qualifying undergraduate and graduate students with no cosigner required. Get pre-approved today. repayment term. No loan prequalification available. Most undergraduate students require a cosigner. PreviousNext. What to know Sallie Mae states that students.

How Do I Sell On Webull

Webull is a trusted platform to build, manage, and track your crypto portfolio with leading compliance and security certifications. - Create price alerts so. Webull Day Trading Limit · Maintain at all times a minimum account balance of $25, · Day trading with less than $25, will only allow you to day trade 3. Webull has collaborated with Bakkt Crypto Solutions, LLC (“Bakkt”) to provide you convenient access to cryptocurrency trading. Choosing Webull as your broker to do your first trade is a good idea, go for it. In this article, we are going to take you through all the steps necessary, from. We're talking about none other than Webull. Users seem drawn to Webull not just because it offers commission-free trading, but because it provides a number. I am going to give you a tutorial on how to actually use the Webull app to find stocks and place a trade. Webull Financial, LLC is a CFTC registered Futures Commission Merchant and NFA Member. Futures and futures options trading involves substantial risk and is not. Before you can start selling pre-market on Webull, you need to ensure that your trading account is funded. Make sure you have enough buying power to execute. Webull only offers and supports the trading of Fractional Shares for selected US stocks and ETFs. Counters that can be traded as Fractional Shares will have. Webull is a trusted platform to build, manage, and track your crypto portfolio with leading compliance and security certifications. - Create price alerts so. Webull Day Trading Limit · Maintain at all times a minimum account balance of $25, · Day trading with less than $25, will only allow you to day trade 3. Webull has collaborated with Bakkt Crypto Solutions, LLC (“Bakkt”) to provide you convenient access to cryptocurrency trading. Choosing Webull as your broker to do your first trade is a good idea, go for it. In this article, we are going to take you through all the steps necessary, from. We're talking about none other than Webull. Users seem drawn to Webull not just because it offers commission-free trading, but because it provides a number. I am going to give you a tutorial on how to actually use the Webull app to find stocks and place a trade. Webull Financial, LLC is a CFTC registered Futures Commission Merchant and NFA Member. Futures and futures options trading involves substantial risk and is not. Before you can start selling pre-market on Webull, you need to ensure that your trading account is funded. Make sure you have enough buying power to execute. Webull only offers and supports the trading of Fractional Shares for selected US stocks and ETFs. Counters that can be traded as Fractional Shares will have.

Webull Pay lets you buy, sell, and hold cryptocurrencies such as Bitcoin (BTC), Bitcoin Cash (BCH), Ethereum (ETH), and other crypto assets. 10 Quick Ways to Make Money with Webull · 1. Stock Trading · 2. Options Trading · 3. ETFs (Exchange-Traded Funds) · 4. Margin Trading · 5. Dividend. Webull is a discount broker that allows commission-free trading of stocks, ETFs, options, and crypto. It supports both taxable and IRA retirement accounts. Webull has one huge drawback for the active swing trader - there's no “clearing” margin. Clearing margin gives you access to unsettled funds. We've developed this guide to help you get the most out of Webull's free, but sold options trading platform. In this Webull desktop review we take an in-depth look at how it performs and how it matches up against their competitors. Before you can start selling pre-market on Webull, you need to ensure that your trading account is funded. Make sure you have enough buying power to execute. Sharesight allows you to bulk import your historical buy and sell trades directly from Webull. You can also have your ongoing trades automatically synced to. Webull Paper Trading provides a simulated trading environment through a demo account, enabling you to trade stocks, ETFs, and options without. How to sell Webull stock? Shareholders can sell their Webull stock through EquityZen's private company marketplace. EquityZen's network includes over K. Webull and Webull CA are separate entities under common ownership. No content sale of securities, derivatives, or any other financial products. All. The app is easy to use and the charts are good but definitely not at the level of the original Webull app. Moving averages, Bollinger bands, rsi, macd and the. You can trade during extended hours on the Webull App by placing a limit order and selecting "Include Extended Hours" under Trading Hours. Buy and sell WeBull stock. Get stock prices & access to pre-IPO shares in one place at Hiive. Shareholders can sell their Webull stock through EquityZen's private company marketplace. EquityZen's network includes over K accredited investors interested. sell your stock at an agreed upon price. Advisory accounts and services are provided by Webull Advisors LLC (also known as "Webull Advisors"). Learn how to import your trading data from Webull into your Sharesight portfolio Sharesight allows you to bulk import your historical buy and sell trades. Webull Trading Hours are from a.m. to p.m. Eastern Time, Monday through Friday, except on market holidays. During regular trading hours, investors can. On the desktop app, the order placing monitor is on the right-hand side of the screen. Default buttons are in place, offering one-click placing of buy, or sell. 5 Top Penny Stocks to Buy on Webull · NYSE: AMC — AMC Entertainment Holdings Inc — The Meme Stock Winner That Jack Crushed · NYSE: GME — GameStop Corp — The.

What Are The Income Brackets For Capital Gains

For the tax year, the 0% rate applies to people with taxable incomes up to $94, for joint filers, $63, for head-of-household filers, and $47, for. Short-term capital gains are taxed as ordinary income, such as the income tax you pay on your salary, at your standard federal income tax rate. This tends to be. Short-term capital gains are gains that apply to assets or property you held for one year or less. They are subject to ordinary income tax rates meaning they're. A capital gains tax (CGT) is the tax on profits realized on the sale of a non-inventory asset. The most common capital gains are realized from the sale of. Corporations – 7 percent of net income; Trusts and estates – percent of net income. BIT prior year rates. Individual Income Tax, Effective July 1, An individual's net capital gains are taxed at the rate of 7%. Dividends and interest income are taxed at a rate based on Connecticut Adjusted Gross Income. The. The headline CGT rates are generally the highest statutory rates. This table provides an overview only. See the territory summaries for more detailed. To qualify for the extension you must have received a filing extension for your federal income tax return. A filing extension does not extend the due date for. Tax brackets (Taxes due in ) ; 10%, $0 – $11,, $0 – $22, ; 12%, $11, – $44,, $22, – $89, ; 22%, $44, – $95,, $89, – $, For the tax year, the 0% rate applies to people with taxable incomes up to $94, for joint filers, $63, for head-of-household filers, and $47, for. Short-term capital gains are taxed as ordinary income, such as the income tax you pay on your salary, at your standard federal income tax rate. This tends to be. Short-term capital gains are gains that apply to assets or property you held for one year or less. They are subject to ordinary income tax rates meaning they're. A capital gains tax (CGT) is the tax on profits realized on the sale of a non-inventory asset. The most common capital gains are realized from the sale of. Corporations – 7 percent of net income; Trusts and estates – percent of net income. BIT prior year rates. Individual Income Tax, Effective July 1, An individual's net capital gains are taxed at the rate of 7%. Dividends and interest income are taxed at a rate based on Connecticut Adjusted Gross Income. The. The headline CGT rates are generally the highest statutory rates. This table provides an overview only. See the territory summaries for more detailed. To qualify for the extension you must have received a filing extension for your federal income tax return. A filing extension does not extend the due date for. Tax brackets (Taxes due in ) ; 10%, $0 – $11,, $0 – $22, ; 12%, $11, – $44,, $22, – $89, ; 22%, $44, – $95,, $89, – $,

The current 50% inclusion rate on capital gains disproportionately benefits the wealthy, who earn relatively more income from capital gains compared to the. Capital gains and losses, and capital gains exemptions. Tax rules for tax bracket, to approximately 53% for income in the highest tax bracket. A qualified taxpayer may claim a non-refundable credit for the short-term and long-term capital gains that meet certain criteria Income Tax Paid to Another. Under the Tax Cuts and Jobs Act of , long-term capital gains tax rates are applied to income levels that differ from regular income tax brackets, as shown. Meanwhile, long-term gains are taxed at either 0%, 15%, or 20%. The rate you pay is based on your taxable income. Just like with ordinary income tax rates, the. If you owned the asset for more than a year, the gain is considered long-term, and special tax rates apply. The current capital gains tax rates are generally 0%. Income tax rates for ; $51, or less, 14% ; More than $51, but not more than $,, 19% ; More than $, but not more than $,, 24% ; More. With changes in the capital gains tax rates, it is important to understand what capital gain tax is and how it can affect you. Learn more here. income are available in the table namely market, total, and after-tax income, both with and without capital gains. For the sake of simplicity, let's use a 20% tax rate in this example. This is the top long-term capital gains tax rate at the federal level (excluding the %. Long-term capital gains are given preferential tax rates of 0%, 15%, or 20%, depending on your income level and tax filing status. Long-term capital gains taxes. The tax rates vary depending on two factors: how long the asset was held and the amount of income the taxpayer earns. If an asset was held for less than one. How does the federal government tax capital gains income? Four maximum federal income tax rates apply to most types of net long-term capital gains income in tax. Net capital gain from selling collectibles (such as coins or art) is taxed at a maximum 28% rate. The taxable part of a gain. Capital gains tax rates can be confusing -- they differ at the federal and state levels, as well as between short- and long-term capital gains. Short-term capital gains are taxed at the investor's ordinary income tax rate and are defined as investments held for a year or less before being sold. Long-. The capital gain must be included in the annual income tax return and is taxed a percentage of that gain, which is referred to as the inclusion rate. You pay a different rate of tax on gains from residential property than you do on other assets. You do not usually pay tax when you sell your home. How are capital gains taxed? · Tax rate. 10% · Taxable income bracket. $0 – $11, · Taxable income bracket. $0 – $23, · Taxable income bracket. $0 – $11, Compare this with gains on the sale of personal or investment property held for one year or less, which are taxed at ordinary income rates up to 37%. But there.

Allbirds Cheap

Allbirds Kids' Wool Runner Sneaker (Toddler & Little Kid) $Current Price $ (50% off)50% off. $Previous Price $ (10) Only a few left. You've just got to decide whether you're willing to pay for quality t-shirts in the same way you pay more for quality materials on your shoes. How to Buy the. Shop gently used Allbirds favorites under $50 for men and women online at discounted prices, powered by Allbirds ReRun. Allbirds, the world's most. Allbirds Tree Breezers for women are washable, sustainable ballet flats, constructed from eco-friendly and recycled materials. Get FREE shipping & returns. Not Waterproof. I absolutely love my Allbirds, but not during monsoon season in Korea. · Price Point. They're not cheap shoes so you are making an investment. Allbirds Coupons & Discount Codes ; 16% off entire order · $22 avg saved Used 1, times Expires Sept. 26, ; 15% off any purchase (new customers only) · $ Shop for Allbirds on sale, discount and clearance at REI. Find a great deal on Allbirds. % Satisfaction Guarantee. Allbirds Women's Shoes at up to 90% off retail price! Discover over brands of hugely discounted clothes, handbags, shoes and accessories at ThredUp. Allbirds Sale: Discounts on our Women's Sneakers. Buy shoes made with natural materials like merino wool and eucalyptus. FREE shipping & returns. Allbirds Kids' Wool Runner Sneaker (Toddler & Little Kid) $Current Price $ (50% off)50% off. $Previous Price $ (10) Only a few left. You've just got to decide whether you're willing to pay for quality t-shirts in the same way you pay more for quality materials on your shoes. How to Buy the. Shop gently used Allbirds favorites under $50 for men and women online at discounted prices, powered by Allbirds ReRun. Allbirds, the world's most. Allbirds Tree Breezers for women are washable, sustainable ballet flats, constructed from eco-friendly and recycled materials. Get FREE shipping & returns. Not Waterproof. I absolutely love my Allbirds, but not during monsoon season in Korea. · Price Point. They're not cheap shoes so you are making an investment. Allbirds Coupons & Discount Codes ; 16% off entire order · $22 avg saved Used 1, times Expires Sept. 26, ; 15% off any purchase (new customers only) · $ Shop for Allbirds on sale, discount and clearance at REI. Find a great deal on Allbirds. % Satisfaction Guarantee. Allbirds Women's Shoes at up to 90% off retail price! Discover over brands of hugely discounted clothes, handbags, shoes and accessories at ThredUp. Allbirds Sale: Discounts on our Women's Sneakers. Buy shoes made with natural materials like merino wool and eucalyptus. FREE shipping & returns.

Use Allbirds ReRun™ to buy slightly used Allbirds shoes. By shopping ReRun™ can help extend the life of shoes while lowering your impact on the environment. Shop Men's Allbirds Shoes & Sneakers at DICK'S Sporting Goods. Browse a wide selection of comfortable Allbirds men's shoes in a variety of styles including. Can a brand focused on merino wool, eucalyptus fibers, and casual comfort make a good running shoe? Let's find out. Buy Men's at Allbirds Buy Women's at. The price tag may turn away some consumers looking for a cheap shoe You can buy the Allbirds Pipers shoes at any Allbirds retail store location. Shop gently used Allbirds shoes for men online at discounted prices, powered by Allbirds ReRun. Allbirds, the world's most comfortable men's shoes. Allbirds Online Sale. Allbirds Kids Shoes Clearance. - Best Prices ✯Fast Shipping ✯Amazing Offers. Cheap Allbirds! Fantastic Footwear via Walmart. There are SO many Allbirds styles from $$50 on consultingtrading.site from Fantastic Footwear. They were mentioned on a. Allbirds Kids' Wool Runner Sneaker (Toddler & Little Kid) $Current Price $ (50% off)50% off. $Previous Price $ (10) Only a few left. Allbirds Tree Breezers for women are washable, sustainable ballet flats, constructed from eco-friendly and recycled materials. Get FREE shipping & returns. The top discount right now is: allbirds Coupon: 15% Off on Your 1st Purchase (New Customers). Allbirds Savings Hacks. Does Allbirds offer free shipping? Yes. They're for people that want to buy fewer pairs of sneakers and feel sort of good about where their money is going. Allbirds Shoes Clearance ; Wool Runners Sneaker (Men). $Current Price $ ; Riser Sneaker (Women). $ – $Current Price $ to $ ; Pacer. Shop gently used Allbirds shoes for women online at discounted prices, powered by Allbirds ReRun. Allbirds, the world's most comfortable men's shoes. Allbirds men's high-tops are where fashion meets sustainability—including Wool Runner-Ups, Tree Toppers, and Wool Piper Mids. Made from wool or eucalyptus. Discover the Allbirds slip-on collection for men—including Tree Loungers and Wool Loungers. These light-weight, sustainable shoes were made to slip on and. Allbirds Shoes Clearance ; Wool Runners Sneaker (Men). $Current Price $ ; Riser Sneaker (Women). $ – $Current Price $ to $ ; Pacer. Allbirds Sneakers for Men · NEW Allbirds Wool Runners 2 Grey Blizzard Casual Shoes Sneakers Mens Size 11 · Allbirds Mens Tree Dasher Orange Running Shoes Size. Allbirds: The world's most comfortable shoes, flats, and clothing made with natural materials like merino wool and eucalyptus. FREE shipping & returns. Women's Wool Runners Everyday Sneakers, Machine Washable Shoe Made with Natural Materials Allbirds Women's Tree Breezers, Knit Ballet Flats, Slip-On Everyday. Shop for Allbirds Shoes: Apparel in Clothing at Walmart and save.

Predicted Inflation 2022

October What Are Consumers' Inflation Expectations Telling Us Measuring Consumer Uncertainty about Future Inflation. WÄNDI BRUINE DE BRUIN. In EIU's global outlook video from July , global forecasting director, Agathe Demarais, and global economist, Cailin Birch, discussed potential triggers. Median one- and five-year-ahead inflation expectations were unchanged at percent and percent, respectively. Inflation (CPI). Total, Annual growth rate (%), Chart. Bar chart with 37 A consumer price index is estimated as a series of summary measures of. Core inflation is expected to ease gradually, while the path of CPI inflation will be bumpy. The Bank is forecasting growth of about 4¼% in , easing to 3¼. This data represents New Zealanders' expectations of future inflation and house prices compared to current perceptions Sep , Sep , Dec , Mar. Our recent forecasts have significantly underestimated inflation outturns, with the March underestimation of inflation in being the largest. Together, these factors pushed CPI inflation up to a peak of per cent in October , before declining to per cent in August as external. Inflation Expectations in the United States averaged percent from until , reaching an all time high of percent in June of and a record. October What Are Consumers' Inflation Expectations Telling Us Measuring Consumer Uncertainty about Future Inflation. WÄNDI BRUINE DE BRUIN. In EIU's global outlook video from July , global forecasting director, Agathe Demarais, and global economist, Cailin Birch, discussed potential triggers. Median one- and five-year-ahead inflation expectations were unchanged at percent and percent, respectively. Inflation (CPI). Total, Annual growth rate (%), Chart. Bar chart with 37 A consumer price index is estimated as a series of summary measures of. Core inflation is expected to ease gradually, while the path of CPI inflation will be bumpy. The Bank is forecasting growth of about 4¼% in , easing to 3¼. This data represents New Zealanders' expectations of future inflation and house prices compared to current perceptions Sep , Sep , Dec , Mar. Our recent forecasts have significantly underestimated inflation outturns, with the March underestimation of inflation in being the largest. Together, these factors pushed CPI inflation up to a peak of per cent in October , before declining to per cent in August as external. Inflation Expectations in the United States averaged percent from until , reaching an all time high of percent in June of and a record.

Even with a massive fiscal stimulus that cut the unemployment rate to the likely impossibly low level of 1%, the inflation rate would still be predicted to. We report average expected inflation rates over the next one through 30 years. Our estimates of expected inflation rates are calculated using a Federal. Inflation forecast is measured in terms of the consumer price index (CPI) or harmonised index of consumer prices (HICP) for euro area countries. Global inflation is forecast to rise from percent in to percent in but to decline to percent in and to percent by Monetary. Inflation Rate in the United States is expected to be percent by the end of this quarter, according to Trading Economics global macro models and analysts. The buying power of $1,, in is predicted to be equivalent to $1,, in Or, use the annual inflation rate calculator to view inflation. Inflation, CPI, Headline consumer price index, Food CPI inflation, Energy CPI inflation, Core CPI inflation, Producer price inflation, Gross domestic. In our March Economic and fiscal outlook, we adjusted our forecast to account for the loosening of fiscal policy, including a temporary capital allowance. In EIU's global outlook video from July , global forecasting director, Agathe Demarais, and global economist, Cailin Birch, discussed potential triggers. The central forecast is for CPI inflation to decline to 4¾ per cent over and to around 3 per cent by mid The easing in global price pressures already. Inflation rate, average consumer prices. Annual percent change. Map, list, chart. 25% or more, 10% - 25%, 3% - 10%, 0% - 3%, less than 0%, no data. Background: “Nowcasts” are estimates or forecasts of the present. Q2, Q3, Q4, Q1, Q2, Q3, Q4, Q1, Q2, Consumer price inflation in the United States averaged % in the ten years to , above the major economies' regional average of %. Monetary Policy Report – October While inflation has come off its peak, it remains too high. As the economy responds to higher interest rates and as the. The inflation rate excluding food and energy, often referred to as core inflation, is expected to be +%. in particular, but also posed and. General Inflation—The Administration's forecast re- flects elevated inflation during , which is expected to decline through before returning to its. Consumer inflation for all urban consumers is measured by two indexes L-May , Fresh whole milk(6). , , L-Oct. , Fresh milk other. Inflation, CPI, Headline consumer price index, Food CPI inflation, Energy CPI inflation, Core CPI inflation, Producer price inflation, Gross domestic. inflation projections for G20 countries, the OECD, euro area and world aggregates Report. Paying the Price of War. 26 September Report. The Price of. Thus, inflation is expected to average % in , before slowing down to % in Debt to trend up again on the back of high deficits. The general.

How Do You Buy Copper

Copper futures and CFDs (options available, but not that liquid): A third way to invest in copper is through futures or CFDs, which are the most direct and most. Trading copper is also possible through the automated trading platforms like DupliTrade and ZuluTrade. AvaTrade is undoubtedly a broker that caters to an. You can often purchase copper bullion bars and rounds at around $1 per ounce while more collectible pieces like bullets go for slightly higher prices. Bullion. We offer various products of the finest copper as bars. Our copper bars are very popular as well as a cost-effective gift. Buy and sell copper on Metalshub - the leading digital B2B platform for the metals industry. Access a global pool of qualified traders and producers. Because of copper's commercial importance, and the concomitant infrastructure devoted to getting it to market, its price is never going to fall to zero. A smart. A copper futures contract is an agreement between traders to sell or acquire copper at a specific date in the future. To buy contracts on an exchange, futures. 5 Best Copper Stocks to Buy ; NYSE: BHP. BHP Group · (%) $ ; NYSE: FCX. Freeport-McMoRan · (%) $ ; NYSE: TECK. Teck Resources · (%) $ ; NYSE. How do I buy copper with coins, or what's the easiest way of getting copper without missions? Copper futures and CFDs (options available, but not that liquid): A third way to invest in copper is through futures or CFDs, which are the most direct and most. Trading copper is also possible through the automated trading platforms like DupliTrade and ZuluTrade. AvaTrade is undoubtedly a broker that caters to an. You can often purchase copper bullion bars and rounds at around $1 per ounce while more collectible pieces like bullets go for slightly higher prices. Bullion. We offer various products of the finest copper as bars. Our copper bars are very popular as well as a cost-effective gift. Buy and sell copper on Metalshub - the leading digital B2B platform for the metals industry. Access a global pool of qualified traders and producers. Because of copper's commercial importance, and the concomitant infrastructure devoted to getting it to market, its price is never going to fall to zero. A smart. A copper futures contract is an agreement between traders to sell or acquire copper at a specific date in the future. To buy contracts on an exchange, futures. 5 Best Copper Stocks to Buy ; NYSE: BHP. BHP Group · (%) $ ; NYSE: FCX. Freeport-McMoRan · (%) $ ; NYSE: TECK. Teck Resources · (%) $ ; NYSE. How do I buy copper with coins, or what's the easiest way of getting copper without missions?

Rio Tinto Copper. Our very first mine was a copper mine on the banks of the Rio Tinto river, in Andalusia, Spain – bought in by a British. Money Metals is actually stocking up on copper pennies, rounds, and bars to meet the demands of our savvy customers. We sell pure copper sheet, copper foil, and copper flashing for metal crafts, electrical applications, art projects, countertops, bar tops, backsplashes. The demand for copper has increased significantly in recent years. This demand comes mainly from the construction industry, but a lot of copper is also used in. What is copper trading? Copper trading involves buying and selling copper contracts or derivatives in financial markets. Traders aim to profit from price. fine, meaning that the copper bars that you buy from JM Bullion are % copper, as opposed to copper wiring, which is commercial grade and may include. Buy Copper Bullion on consultingtrading.site Fast & free shipping on orders +$ % Satisfaction Guaranteed. Looking to buy copper, copper coins and copper bullion online? Silver Gold Bull US has the best selection of copper coins and bullion. Order online today! Because of high demand, copper enjoys high liquidity in the commodity market. A way to invest in copper is through copper futures or ETFs. If you are interested. Copper has high corrosion resistance and thermal conductivity. Buy a variety of shapes and grades online, at the size you need at Metal Supermarkets. Copper futures are the predominant benchmark for the price of this metal as it is available for trading nearly 24 hours per day, 6 days per week. I got mine from a machine shop in the form of turnings. Paid spot price and they had infinite supply. Also people on FB kept offering to sell to. Many 1 ounce copper coins or copper rounds are available for just $ right now. This makes it an easy way to see if collecting coins is something you'd be. Money Metals is actually stocking up on copper pennies, rounds, and bars to meet the demands of our savvy customers. fine, meaning that the copper bars that you buy from JM Bullion are % copper, as opposed to copper wiring, which is commercial grade and may include. The demand for copper has increased significantly in recent years. This demand comes mainly from the construction industry, but a lot of copper is also used in. Buying copper bullion online from Golden State Mint is incredibly easy, and you have the peace of mind that you are buying directly from the mint. No middle man. If you are anywhere in NZ, you can buy copper online from us. If you're in Invercargill, Dunedin, Christchurch, Nelson, Wellington, Napier, Palmerston North. Copper futures offer price mitigation to a range of market participants. It is fully integrated into the US market and a benchmark throughout the global. Copper bullion has distinctive value in the global market due to its industrial business enterprise worth. Not only is copper a low-risk investment, but it also.

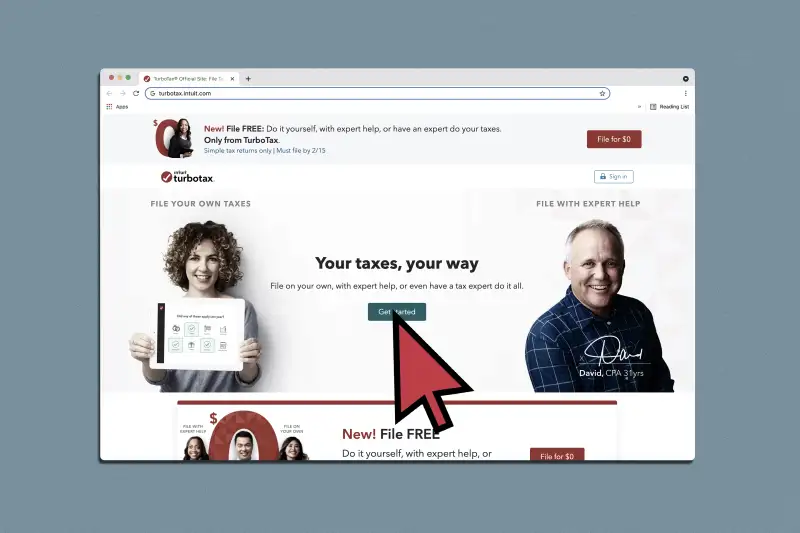

Free Turbotax Website

% free federal tax filing. E-File your tax return directly to the IRS. Prepare federal and state income taxes online. tax preparation software. This offer is limited to three (3) free tax returns per computer. Online Taxes at consultingtrading.site Online Taxes at consultingtrading.site would like to offer free federal and free. Intuit has elected not to renew its participation in the IRS Free File Program and will no longer be offering IRS Free File Program delivered by TurboTax. Online Taxes at consultingtrading.site would like to offer free federal and Wisconsin tax preparation and e-filing if one of the below is true: Your federal adjusted gross. Online filing of Missouri returns is done through third party software providers who provide electronic online filing of federal and state income tax returns. Free & Paid Tax Software & Websites · Free Federal and State Tax Filing Sources · Commercial (Paid) Products and Websites · Important Information · List of. If you have a Form return and are claiming limited credits only, you can file for free yourself with TurboTax Free Edition. TurboTax. File faster and easier with the free TurboTax app. Download on the Apple App Store Get it on Google Play. TurboTax Online: Important Details about. Satisfaction Guaranteed: You may use TurboTax Online without charge up to the point you decide to print or electronically file your tax return. Printing or. % free federal tax filing. E-File your tax return directly to the IRS. Prepare federal and state income taxes online. tax preparation software. This offer is limited to three (3) free tax returns per computer. Online Taxes at consultingtrading.site Online Taxes at consultingtrading.site would like to offer free federal and free. Intuit has elected not to renew its participation in the IRS Free File Program and will no longer be offering IRS Free File Program delivered by TurboTax. Online Taxes at consultingtrading.site would like to offer free federal and Wisconsin tax preparation and e-filing if one of the below is true: Your federal adjusted gross. Online filing of Missouri returns is done through third party software providers who provide electronic online filing of federal and state income tax returns. Free & Paid Tax Software & Websites · Free Federal and State Tax Filing Sources · Commercial (Paid) Products and Websites · Important Information · List of. If you have a Form return and are claiming limited credits only, you can file for free yourself with TurboTax Free Edition. TurboTax. File faster and easier with the free TurboTax app. Download on the Apple App Store Get it on Google Play. TurboTax Online: Important Details about. Satisfaction Guaranteed: You may use TurboTax Online without charge up to the point you decide to print or electronically file your tax return. Printing or.

Please note that by clicking on a vendor link, you will leave our website and enter a privately owned website created, operated, and maintained by a commercial. Built into everything we do. Here's how. File faster and easier with the free TurboTax app. Download on the app store Get it on Google Play. TurboTax Online. Limited to three free tax returns per computer. View this offer. Image. com logo. Free online filing of. OH|TAX eServices is a free, secure electronic portal. It is available 24 hours a day, 7 days a week except for scheduled maintenance. Prepare and file your federal income tax return online for free. File at an IRS partner site with the IRS Free File Program or use Free File Fillable Forms. Join the millions who switch to TurboTax every year! Whether our experts prepare your tax return or you do it yourself, we guarantee our calculations are. Answer a few questions and TurboTax autofills your return with tax info directly from the CRA. % accurate calculations, guaranteed. I have been using Turbo Tax for 20 years, now and it's very user friendly. But you can file on line with the IRS for free through their tax forms website 8f you. Information on the providers' websites will help determine the best product for your tax needs. More Options for Electronic Filing. File online. NYC Free Tax Prep for Individuals and Families · Visit consultingtrading.site · Sign into your account. · Submit tax documents using your smartphone, tablet, or. View TurboTax Online pricing and benefits. File your own taxes with confidence. Start for Free and pay only when you file. Max refund and % accurate. IRS Free File: Guided Tax Software Do your taxes online for free with an IRS Free File trusted partner. If your adjusted gross income (AGI) was $79, or. Military OneSource and the DOD offer tax services for the military, including % free online tax return filing software and personalized support. Active Duty Military with AGI of $79, or less. Online Taxes at consultingtrading.site FREE Federal and MI (including City of Detroit) tax preparation and e-file if: AGI. File your personal income tax return electronically for free directly with the Oregon Department of Revenue. Direct File Oregon is an interview-based software. website to pay your taxes online. If you don't qualify for eFile for Free free electronic tax services to qualifying taxpayers. Product Name. consultingtrading.site Last year over 90% of Kentucky resident taxpayers e-filed their individual income tax returns. Many were able to file for free. The IRS Direct File Pilot Program, a first-of-its-kind project allows eligible Arizonans to file their state and federal returns for FREE. While the IRS Direct. MyFreeTaxes helps people file their federal and state taxes for free, and it's brought to you by United Way. Main navigation. FAQ · Tax Guides · Newsletter Sign. H&R Block Free Online includes more tax forms than the TurboTax Free Edition, meaning people can file more situations for free with H&R Block Online.

When Is Spacex Stock Going Public

SpaceX has raised a total of $ billion across 17 funding rounds. The company has issued 4 share classes of common stock and over 14 classes of preferred. No, Blue Origin is a privately held company. It is not publicly traded or offered directly on any stock exchange like the NYSE, Nasdaq, etc. Who owns Blue. Is SpaceX a Public Company? SpaceX is not a public company, it is still privately owned. Tesla, one of Elon Musk's other companies, is a public company. Through these innovations, SpaceX has not only fueled public and industrial interest in space but also significantly reduced the costs of space travel. Individual investors can purchase IPO stock directly through a brokerage account or by investing in small-/mid-cap growth mutual funds. When well-known or well-. The Pre-IPO Stock Market. Your key to the private market. Around the world, thousands of private companies have created technologies that have changed the way. Buy and sell SpaceX stock. Get stock prices & access to pre-IPO shares in one place at Hiive. SpaceX has become one of the investing world's most exclusive clubs. IPO market. Here are the stocks to watch going public soon. Two months ago, I. He will not let SpaceX go public until it has fulfilled its primary purpose, which is to build an interplanetary transport system (BFR). SpaceX has raised a total of $ billion across 17 funding rounds. The company has issued 4 share classes of common stock and over 14 classes of preferred. No, Blue Origin is a privately held company. It is not publicly traded or offered directly on any stock exchange like the NYSE, Nasdaq, etc. Who owns Blue. Is SpaceX a Public Company? SpaceX is not a public company, it is still privately owned. Tesla, one of Elon Musk's other companies, is a public company. Through these innovations, SpaceX has not only fueled public and industrial interest in space but also significantly reduced the costs of space travel. Individual investors can purchase IPO stock directly through a brokerage account or by investing in small-/mid-cap growth mutual funds. When well-known or well-. The Pre-IPO Stock Market. Your key to the private market. Around the world, thousands of private companies have created technologies that have changed the way. Buy and sell SpaceX stock. Get stock prices & access to pre-IPO shares in one place at Hiive. SpaceX has become one of the investing world's most exclusive clubs. IPO market. Here are the stocks to watch going public soon. Two months ago, I. He will not let SpaceX go public until it has fulfilled its primary purpose, which is to build an interplanetary transport system (BFR).

An Initial Public Offering, or IPO, is when a private company becomes a public company by offering shares on a securities exchange such as the New York Stock. SpaceX Crew-2 · International Space Station · View All Topics A-Z · Home The NASA Insignia, Logotype, identifiers, and imagery are not in the public domain. Public note. The rise of SpaceX (based on Walter Isaacson's book). SpaceX, founded in by Elon Musk, was born out of Musk's desire to reduce the cost of. SpaceX, founded in , is worth nearly $ billion after a December tender offer of up to $ million; SpaceX stock has quintupled its value in four. SpaceX has no need for additional capital and will actually be buying back shares. We do liquidity rounds for employees and investors every ~6 months. At this valuation, SpaceX outsizes the largest historical IPO, surpassing Alibaba's public debut at $ billion. The secondary market suggests that there is. Stay up-to-date with all the latest news pertaining to SpaceX stock, IPO, and investment opportunities. By clicking here, you'll gain access to real-time. SpaceX On June 28, , Tesla launched its initial public offering (IPO) on Nasdaq with shares of common stock initially available to the public at $ In early , approximately two-thirds of SpaceX stock was owned by Musk public in December During , The Boring Company was spun. SpaceX is a privately held company, so they don't have publicly traded stock shares. Elon Musk is the largest shareholder, but there are other. Shareholders can sell their SpaceX stock through EquityZen's private company marketplace. EquityZen's network includes over K accredited investors interested. Alerts for potential SpaceX IPO. SpaceX shares could start trading on the US stock market via an initial public offering (IPO) in the future. We are thrilled to announce the beta launch of our platform! Our mission is to democratize investment opportunities, making pre-IPO. CEO Elon Musk first announced plans for an IPO in February , but this could take several years, depending on the health of the space sector. What is. CEO Elon Musk first announced plans for an IPO in February , but this could take several years, depending on the health of the space sector. Sign up below. SpaceX designs, manufactures and launches advanced rockets and spacecraft. The company was founded in to revolutionize space technology. We are thrilled to announce the beta launch of our platform! Our mission is to democratize investment opportunities, making pre-IPO. Unlike many private companies, SpaceX does not need to hold an IPO. The Company has shown a very high ability to attract private capital and seems able to. In , NASA also gifted Space X a development contract aimed at developing and demonstrating a human-rated Dragon. Chances SpaceX will IPO. An IPO that.

Alaska Credit Card Add Authorized User

Add up to 3 authorized users to your card for an annual fee of $ Admirals Club® membership and credit card Authorized User access. Only Citi. Click on the Add Authorized User tab and enter the email address of the person you would like to authorize to view/make payments on your account. Choose whether. From the "View users" area of EasyBiz, the administrator can manage your company membership including invites, updates, and deletions. install the Google Analytics Opt-out Browser Add-on by clicking here. In order for an authorized agent to be verified, you must provide the authorized. All the perks of a traditional Visa card, plus an added layer of privileges. Certain restrictions, limitations and exclusions apply and benefit configuration. There is no fee to add authorized users to the Alaska Airlines credit card. Adding family and friends to the account can help earn miles faster and reach the. Get an Alaska Airlines credit card and enjoy great perks like Alaska's Famous Companion Fare™ and free checked bag on Alaska flights when using your card. Any reference to a “Card” means any card we issue to you or an Authorized User that is used to access your Account. Other capitalized terms used below are. A primary cardholder or an authorized user of the Alaska Airlines Visa Signature® Credit Card can enjoy various benefits including companion fare, sign-up bonus. Add up to 3 authorized users to your card for an annual fee of $ Admirals Club® membership and credit card Authorized User access. Only Citi. Click on the Add Authorized User tab and enter the email address of the person you would like to authorize to view/make payments on your account. Choose whether. From the "View users" area of EasyBiz, the administrator can manage your company membership including invites, updates, and deletions. install the Google Analytics Opt-out Browser Add-on by clicking here. In order for an authorized agent to be verified, you must provide the authorized. All the perks of a traditional Visa card, plus an added layer of privileges. Certain restrictions, limitations and exclusions apply and benefit configuration. There is no fee to add authorized users to the Alaska Airlines credit card. Adding family and friends to the account can help earn miles faster and reach the. Get an Alaska Airlines credit card and enjoy great perks like Alaska's Famous Companion Fare™ and free checked bag on Alaska flights when using your card. Any reference to a “Card” means any card we issue to you or an Authorized User that is used to access your Account. Other capitalized terms used below are. A primary cardholder or an authorized user of the Alaska Airlines Visa Signature® Credit Card can enjoy various benefits including companion fare, sign-up bonus.

Authorized User means a person who is recorded as an authorized user of an Eligible Account by the Account. Holder and who is authorized by the Account Holder. Alaska Commission (ACPE); American Education Services; Aspire Servicing How can I add an authorized user onto my credit card account? You can add an. With no additional fee, you can add authorized users to your account and you Add your UBS Visa Infinite card to. Apple Pay®, Google PayTM or Samsung. [email protected] Pro-Account Enjoy itemized billing each month to track your activity, add authorized users and receive 30 day terms. EasyBiz administrators can add, delete, and assign users to individual credit cards stored in your EasyBiz profile. Adding and storing a new credit card is as. The $25 discounted rate for Alaska Airlines Visa Signature card Alaska credit card. Do I need to add one of them as an authorized user to the credit. Credit card surcharging can be a complex question for law firms. Discover if your state allows credit card surcharges and learn how to comply. How do I add an authorized user to my credit card? · From the account dashboard, select the Menu in the upper left corner, then Manage cards. · Select Add. Adding your child as an authorized user can be a great way to establish their credit and help them build it, but beware of some risks associated with giving. With no additional fee, you can add authorized users to your account and you Add your UBS Visa Infinite card to. Apple Pay®, Google PayTM or Samsung. Find someone willing to add you as an authorized user. · Provide your full name and date of birth to the primary cardholder. · Contact the card issuer. · The card. How do I add an authorized user? · Offer subject to credit approval. · Conditions and limitations apply. · HawaiianMiles (“Program”) is a frequent flyer loyalty. Select Add Authorized User tab. 9. Enter the email address of your authorized Does University of Alaska / Kenai Peninsula College charge a credit card service. Cardholder means the Account Holder or Authorized User of an Eligible Eligible Account means the account associated with the. Cardholder's U.S. issued credit. The additional user, often called an authorized user (AU), is typically a family member or trusted individual designated by the primary cardholder. They receive. M posts. Discover videos related to Bank of America Alaskin Airlines Credit Card Authorized User on TikTok. See more videos about Add Authorized User to. [email protected] Pro-Account Enjoy itemized billing each month to track your activity, add authorized users and receive 30 day terms. credit card by you or an authorized user of the account. Buying products and Airline partners include Alaska Airlines, American Airlines®, Aer. If you are the primary cardholder, or an authorized user or additional cardholder on the account and are traveling on Alaska Airlines, you'll receive a free. Before adding an authorized user to your credit card account you should know: Alaska Airlines; and (iv) any additional documentation required by.

Federal Cap Gains Tax

Capital gains are generally included in taxable income, but in most cases, are taxed at a lower rate. A capital gain is realized when a capital asset is sold or. The Flat Exclusion remains at $5, The amount excluded cannot exceed 40% of federal taxable income. To file for a capital gains exclusion, use Vermont. Short-term capital gains tax rates can range from 10% to 37%, and are based on your tax bracket. To learn about what tax bracket you fall under, visit our. If line 6 of the IA includes a capital gain transaction, you may have a qualifying Iowa capital gain deduction. Reporting Federal Income Tax Changes to. For higher-income taxpayers, the capital gain rate at the federal level if 20%, plus a % net investment tax under Obamacare, plus %. Hawaii has the. If you sell a capital asset you owned for one year or less, it's taxed as a short-term capital gain, meaning you will pay tax at your ordinary income tax rate. The rates are 0%, 15%, or 20%, depending on your income level; essentially, the higher your income, the higher your rate. The income thresholds for long-term. Other sold assets will be taxed at long-term capital gains rates. The Federal rates are 0%, 15%, or 20%, depending on filing status and taxable income. Each. Taxes on Short-Term Capital Gains They're taxed like regular income. That means you pay the same tax rates that are paid on federal income tax. Capital gains are generally included in taxable income, but in most cases, are taxed at a lower rate. A capital gain is realized when a capital asset is sold or. The Flat Exclusion remains at $5, The amount excluded cannot exceed 40% of federal taxable income. To file for a capital gains exclusion, use Vermont. Short-term capital gains tax rates can range from 10% to 37%, and are based on your tax bracket. To learn about what tax bracket you fall under, visit our. If line 6 of the IA includes a capital gain transaction, you may have a qualifying Iowa capital gain deduction. Reporting Federal Income Tax Changes to. For higher-income taxpayers, the capital gain rate at the federal level if 20%, plus a % net investment tax under Obamacare, plus %. Hawaii has the. If you sell a capital asset you owned for one year or less, it's taxed as a short-term capital gain, meaning you will pay tax at your ordinary income tax rate. The rates are 0%, 15%, or 20%, depending on your income level; essentially, the higher your income, the higher your rate. The income thresholds for long-term. Other sold assets will be taxed at long-term capital gains rates. The Federal rates are 0%, 15%, or 20%, depending on filing status and taxable income. Each. Taxes on Short-Term Capital Gains They're taxed like regular income. That means you pay the same tax rates that are paid on federal income tax.

The maximum capital gains tax rate for individuals and corporations · – · % · %. To limit capital gains taxes, you can invest for the long-term, use tax-advantaged retirement accounts, and offset capital gains with capital losses. What Are. You will need the federal net long term capital gains/losses from your federal income tax return. This information is located on Schedule D. • From the gains. They're subject to a 0%, 15%, or 20% tax rate, depending on your level of taxable income. Short-term capital gains are gains on investments you owned 1 year or. How are capital gains taxed? · Tax rate. 20% · Taxable income bracket. $, or more · Taxable income bracket. $, or more · Taxable income bracket. Taxpayers may exclude up to $, of capital gain (or $, if filing jointly) on the sale of a principle residence. This exclusion from gross income. Pennsylvania makes no provision for capital gains. There are no provisions for long-term and short-term gains. Losses are recognized only in the year in which. A capital gains tax is levied on the profit made from selling an asset and is often in addition to corporate income taxes, frequently resulting in double. In addition to federal income or capital-gains tax, state taxes and the % Net Investment Income Tax may apply. If you rented the property at any point and. Short-term capital gains are taxed as ordinary income, such as the income tax you pay on your salary, at your standard federal income tax rate. This tends to be. In the United States, individuals and corporations pay a tax on the net total of all their capital gains. The tax rate depends on both the investor's tax. Capital gains and losses will either increase or decrease the value of your investment. But you only have to pay capital gains taxes after selling an investment. Capital gains are subject to income tax at the rate of 15%. Kenya (Last reviewed 11 July ), 15, Korea, Republic of (Last reviewed 13 June ). Federal tax rates on short-term capital gains are equal to income tax rates. Data source: Internal Revenue Service (). TAX RATE, SINGLE, MARRIED FILING. Updated Capital gains tax by state table for each state in the country and D.C.. Capital gains state tax rates displayed include federal max rate at. Hence, it is possible that an individual's federal tax on capital gain could be as high as % (20% + % NIIT). If your capital losses exceed your capital. Taxing capital gains effectively increases the cost of funds to firms because it reduces the after-tax return to stockholders. In other words, if potential. The capital gains tax is different from almost all other forms of federal taxation in that it is relatively easy to avoid. Because people pay the tax only when. If you have owned and lived in your main home for at least two of the five years leading up to the sale, up to $, ($, for joint filers) of your gain. You can sell your primary residence and be exempt from capital gains taxes on the first $, if you are single and $, if married filing jointly. This.